Updating the Estate Plan

"Estate planning is like a spare tire. You don’t think about it until you really need it."

(Merry Christmas! Today, I removed the paywalls on all the previously “paywalled” articles for the week until New Year’s! In addition to this article, consider catching up with the Fighting Reward Card Inflation, Do you have sleep apnea?, Housing Choices —Cows and Milk, and A Digital Estate Planning Concern if you were previously paywalled — or if you just didn’t get reading them! Now’s a great time to do it!)

In this post, I’ll discuss our experiences with estate planning. Since 1999, Marsha and I have had our assets in a trust, and we just signed the paperwork on the third revision. This isn’t the most exciting topic, I know, but one requested by a friend in an iMessage thread, as well as one that just about every retiree should revisit.

What is a trust?

A trust is a legal entity, similar to a person or a corporation. For the purposes of estate planning, a trust involves a written document describing how assets are to be used during a lifetime and later distributed. In the case of our estate plan, Marsha and I are the “grantors” (the creators of the trust), the “trustees” (the people in charge of handling the affairs), and the “beneficiaries” (the people for whom the entrusted assets are being held for.) Our trust is currently a living trust, as it is designed for use during our lifetime. Our living trust is a revocable trust, meaning we can also change or terminate it while we are alive.

The reason we created the trust back in 1999 when our kids were small was to control how and when assets could be distributed if Marsha and I were to both die early. In the event of our deaths, Marsha’s brother would become the “trustee” and our kids would become the “beneficiaries.” We outlined rules for how our assets could be used, primarily to ensure that the kids could be guided on a good path before they could become financially responsible on their own. The advantage of the trust in this case is that it would allow our estate to bypass probate (a public, court-supervised process) and hopefully minimize potential delays and extra work for those who survived us.

The process was pretty straightforward. Back when we originally set up our trust, we just had an attorney draft up documents, and then we re-titled our assets (our home, our brokerage accounts, our bank accounts, etc.) from our names into the name of the trust. For the purposes of taxes, the trust is a disregarded entity, so I can simply report the income and expenses of the trust on our personal tax return.

Some asset types, such as IRAs, 401(k), and Health Savings Account (HSA) balances cannot be held by a trust, so those are still in our names. In this case, Marsha and I are each other's primary beneficiary in case of death. For the contingent beneficiary, we have specified our trust. Back when I held company stock options (ISOs), those could also not be held in trust, but that’s not an issue any longer!

Time to update

We are just completing our third iteration of our estate plan. As mentioned, we did our initial trust right as Latitude was going public in 1999. At that point, we had the Pao 1999 Family Trust. We revoked it in 2013 as Barracuda was going public, in favor of the 2013 Pao Family Trust. Now six years retired, we did the First Amendment to the 2013 Pao Family Trust, so we don’t need to retitle our assets again!

We had several reasons to update our estate documentation:

We hadn’t updated our estate documentation in over 10 years. In general, the recommendation is to update healthcare directives every decade.

We moved states. Our prior trust documents were set up in California. While the trust document was still legally valid, our financial advisor at JPMorgan suggested that we just have Oregon lawyers take a look at it, and they provided a list of 3 recommended choices. We hired Stoel Rives. This firm provided an excellent educational piece for prospective clients about Oregon estate planning.

Our kids are older. Back when we did the last two iterations of our trust, our kids were still minors. Today, they are 26 (almost 27!) and 24. They are both responsible adults with advanced degrees, and they get along really well. We decided there was no need on our deaths to have a third-party trustee, so we decided to eliminate that step!

This was fresh in our minds. Marsha’s mom passed away in January of this year, and her brother was managing the process of their mom’s estate this year. We set a timeline to update our own plan in 2024, and we’re just squeaking to the very end of the year to get this done!

Overall, our aim was to keep this very simple, while retaining flexibility. My friend in our iMessage thread asked about generation-skipping, and we aren’t even thinking about this! The primary reason is that we don’t expect to have that much by the time Marsha is 100 (her Mom who never exercised lived to almost 94!) and by the time we’ve provided any necessary help to our kids. In addition, we wanted to retain flexibility and we don’t want to set up any irrevocable vehicles this early!

A simple process

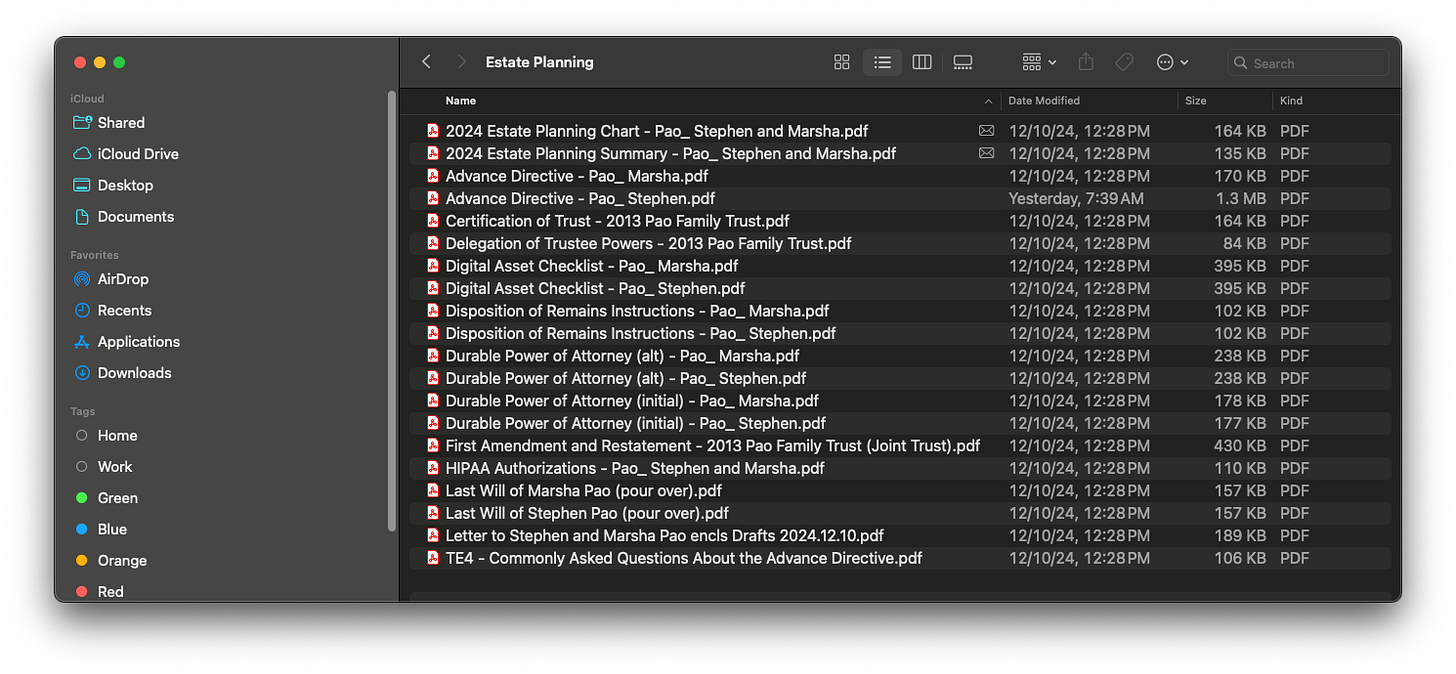

As mentioned, we already had a set of estate documents, last updated in 2013. I have just stored these in a Dropbox folder since 2013, as well as the paper copy originals in a fireproof safe. Basically, these files just sat there, but from time-to-time, I had to share the “trust certification” with banks and other financial entities.

For updating our estate plan, Stoel Rives gave me an account on box.com, where I securely uploaded these files. I also filled out the standard Stoel Rives “Current 2024 EP Questionnaire - Couple” and uploaded it to box.com.

From there, we just had a single (very informative) meeting with our attorney where we clarified details, and the team went to work on documents! We got a bunch back to review!

The one homework assignment we had was to fill out the Advanced Directives. Again, Stoel Rives provided us with a guide. I also referred to the updated digital asset checklists I am still working on in a previous post.

From there, we sent a few emails back and forth with questions and set up a signing appointment in their office, where they had both witnesses and a notary ready to go. We still have to present the Advance Directive documents to our kids and get their “wet ink” signatures on them when we all see each other face-to-face over the holidays. However, these documents don’t need to be notarized, so for now, we are good to go!

We haven’t been invoiced yet, but the firm set the expectation that our fees would be like $5K-$6K to get all this done.

Highlights

From our perspective, this updated plan has several benefits:

Simpler. We no longer have to worry about restricting the use of our assets through a third-party trustee like Marsha’s brother after our death. Before, we had rules about the use of money for living and education expenses. Now, we are simply entrusting our kids to do what’s best for them if we both pass early.

Updated healthcare directives. The modern healthcare directives are more specific now that go beyond just simply terminal conditions but also ones where we might not be able to make decisions for ourselves, as well as end-of-life care options. In addition, there are now places where we can state our goals right on the forms.

Better durable power-of-attorney documents. Now that our kids are older, we can better set up for our own potential incapacity. While Marsha and I are each other’s initial power of attorney, we have our kids now set up as alternate power of attorney should both Marsha and I no longer be capable.

More specificity about what to do with our remains. These documents now allow us to specify in more standard terms how we want our remains and funeral arrangements to be handled.

Handling of the Oregon estate tax in the scheme. The diagram explains it well in the case of my passing first. (There’s a separate diagram if Marsha passes first.)

Of course, all of this is in place as a structure that can continue to be revised, as our life situation changes. For now, this works and feels OK.

Important but not urgent

Recall the discussion I had before about the Eisenhower Matrix. This task of updating the estate plan is “important and not urgent.” The right next step is to “DECIDE” to do it by planning and scheduling it.

For us, back in March, after the memorial service for Marsha’s mom, we decided to do it by year end. Today is Christmas day, and we didn’t sign and notarize until last week! This was last minute, but on schedule!

When are you going to plan to update your estate plan?

Note that this Wednesday’s post will go out without a paywall forever and is being sent to the Sunday mailing list, too. I figured this one is a public service announcement as everyone should update their estate plans if they haven’t done it in the last 10 years! Consider setting a New Year’s Resolution to get to it!

Sorry I spelled your name wrong, Stephen.

Hi Steven. Facebook kept suggesting I connect with you and then I remembered that we met at Laird's dad' memorial and then I found your newsletters. Such great reads! And I hadnt know about Substack either. As Laird says, it's so important to involve the kids in what you are doing, if possible, but I still wonder at what ages to bring up certain things. When my kids were maybe 7 years old, I told them I set up Roth IRAs from hiring them at 3 months old to be in a commercial for my office. But they didn't really understand what a Roth IRA was, because they barely understood taxes. I tried to compare the Roth with a traditional IRA but it didn't register with them. When my son got a Hannukah gift from my brother at age 8 or 9, I said let's put half in your checking account and half in your savings. My son confused the savings account with what he remembered of a traditional IRA and said, "Oh no! You're not going to lock it up until I'm 59 years old. What a stupid thing to do!" It was funny but made me realize there are appropriate conversations for each age. Right now they are almost 16 and we're going through the fires in Los Angeles now, so we discussed insurance. I'd like to find a list of what to bring up at what age, so they are interested and not overwhelmed and confused. But yes when the kids reach adulthood (in age and maturity), it is so important to involve them in estate planning and your goals. Have a great 2025. I'll be reading more of your newsletters.