MileagePlus Rewards in Retirement: A Different Game Entirely

How airline miles and credit card strategies change when your travel patterns shift

I've written before about reward card inflation and my preference for straightforward cash back rewards over the increasingly complex world of airline miles. My biggest gripe remains unchanged. Airlines keep devaluing their points. United eliminated award charts for tickets in 2019 in favor of dynamic pricing, and they're eliminating award charts for upgrades later this year.

Yet here we are in retirement, still traveling and still accumulating miles, albeit in much smaller quantities than my business travel days.

When Travel Patterns Change Everything

The shift from business travel to retirement travel has completely upended our miles strategy. In my working years, I accumulated large quantities of miles from frequent business trips, and we'd spend them from my single account for family travel. Simple and straightforward.

Now, Marsha and I typically travel together, earning roughly equivalent miles on each trip.

Having two small accounts of roughly equal size creates an entirely different challenge when it comes to redemption time.

The Miles Pooling Solution (And Its Complications)

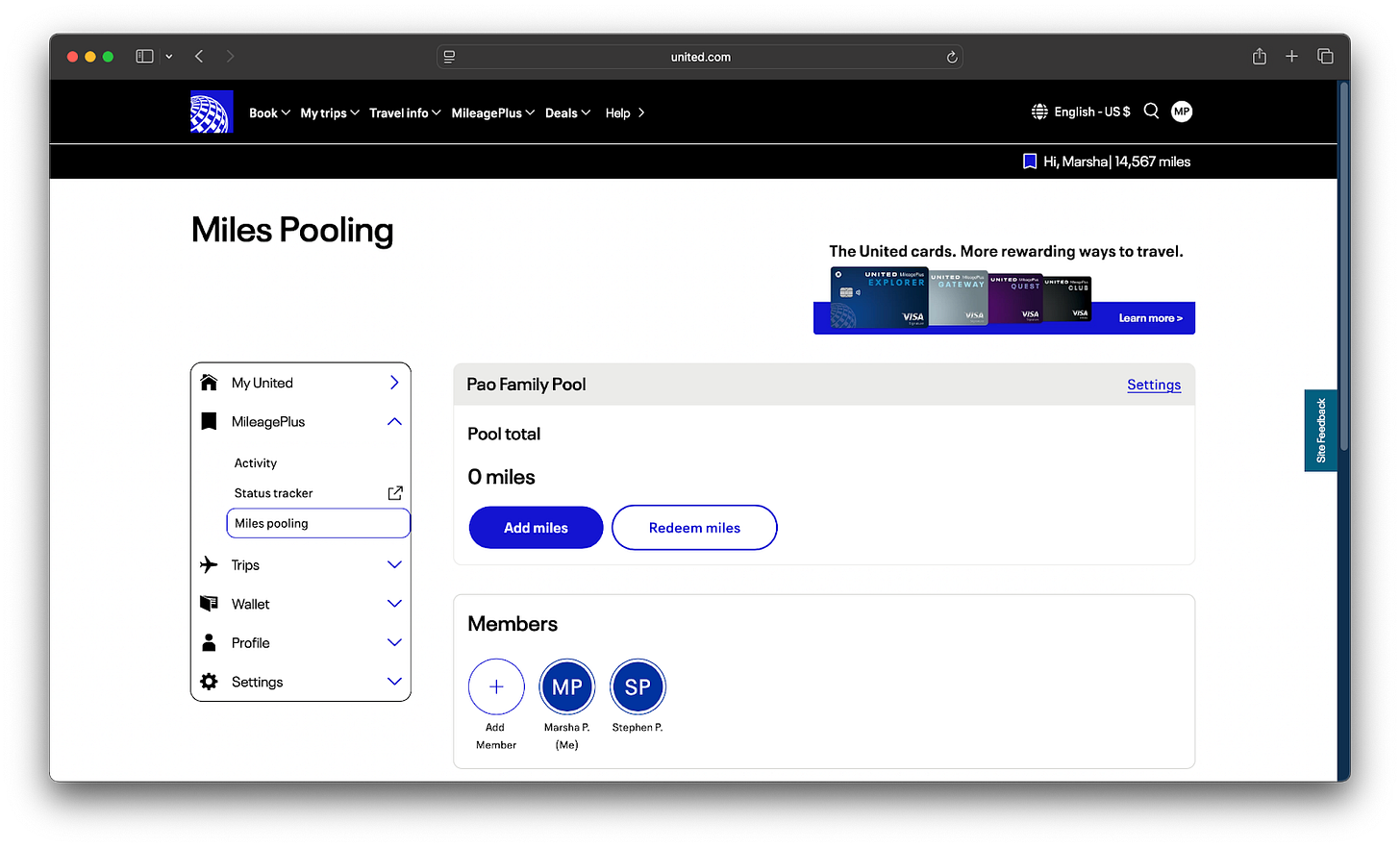

If we each spent our miles individually, we'd end up with two separate itineraries. United doesn't allow redemptions from two different MileagePlus accounts on the same booking. To avoid the risk of getting bumped separately, we've joined United's "miles pooling" feature, which allows me and Marsha to combine our points so that Marsha can book us on a single itinerary.

Sounds perfect, right? Not quite.

The Catch: Upgrades vs. Awards

A savvy observer will notice that the current balance of our miles pool is zero. Here's where it gets tricky: miles pooling can only be used for award ticket redemptions, not for purchasing seat upgrades. This means we can't simply dump all of our miles into the pool and call it a day.

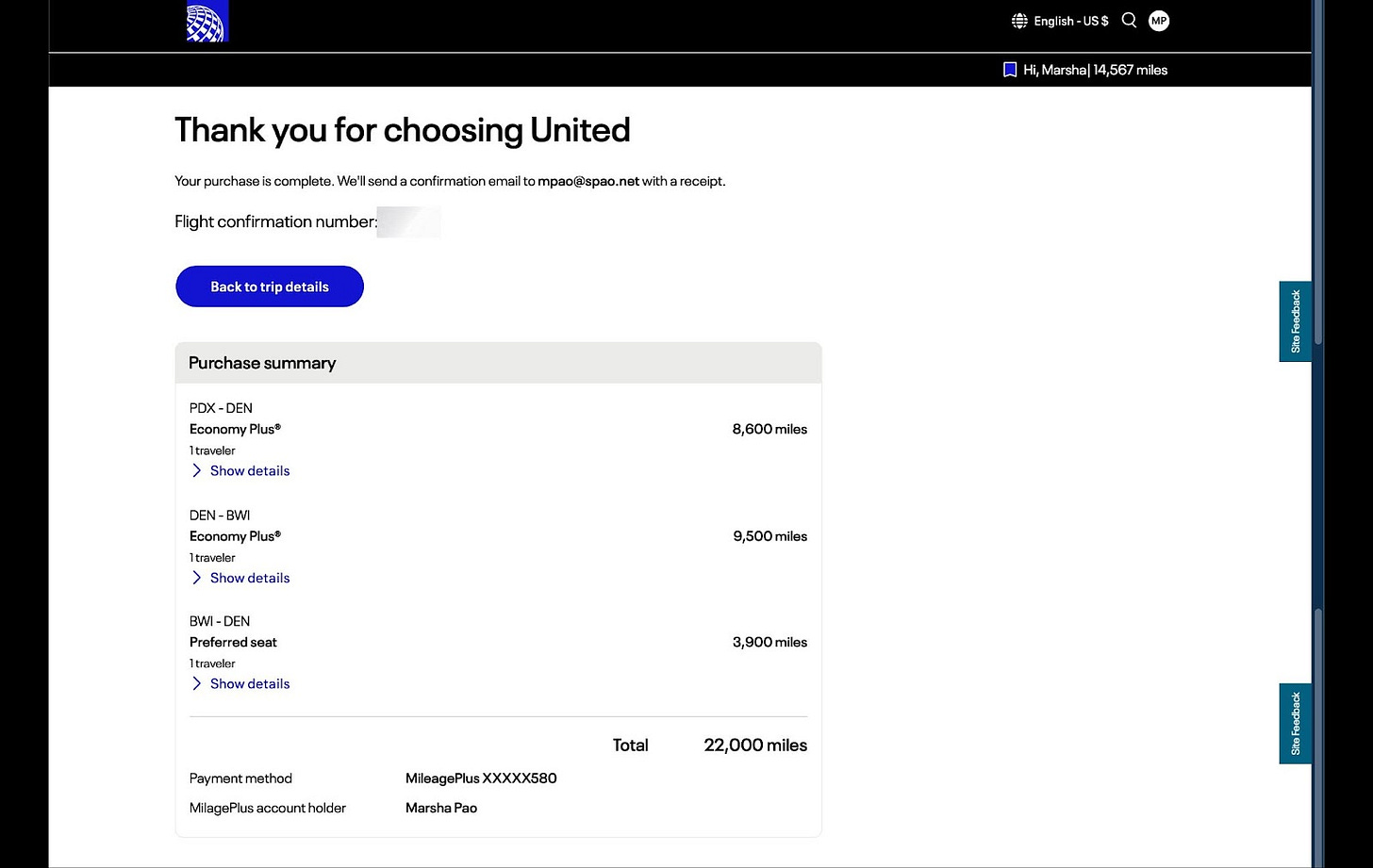

For my upcoming trip to the memorial service for a friend’s mom, we booked a saver award ticket for me. Marsha then used her individual account miles to purchase my seat upgrade. Had she already contributed all her miles to our pool, this seat upgrade wouldn't have been possible.

The Planning Tax

All of this requires more advanced planning than our old approach. Once miles transfer to a pool, they're frozen for 24 hours. Every vacation involving pooled miles becomes a multi-step process: research the dynamic pricing of the tickets, pay for a FareLock (or pray the dynamic pricing doesn’t change or disappear during the transfer period), transfer points, wait 24 hours, then book.

I suspect this 24-hour delay is United's way of ensuring only people with time on their hands, like retirees, bother with this feature, rather than busy professionals looking for efficiency.

Strategic Choice of Pool Leader

There's another layer to consider. As regular readers may have noticed in my post about packing, we now carry a United Quest card alongside our Alaska Mileage Plan card. Because we put the United Quest card in Marsha's name, she leads our miles pool and handles reservations to maximize our card benefits.

Why We Still Bother With United

With all these complaints about MileagePlus complexity, you might wonder why we stick with United. The answer is route convenience. Our older daughter lives in Princeton (easy train ride from Newark), our younger daughter is in Chicago, and my mom and sister are in Houston. All United hubs, all non-stop from Portland.

When connections are unavoidable, our JPMorgan Reserve Card's unpublished benefit of UnitedClub access makes layovers more tolerable, a small luxury that I appreciate even more in retirement than I did during my hurried business travel days when I’d be on my mobile phone during layovers anyway.

The Bottom Line

Optimizing travel rewards in retirement is work, arguably more complex than when I was earning miles through business travel. Between managing credit card strategies, MileagePlus redemptions for both awards and upgrades, and navigating miles pool logistics, the rules of the game have fundamentally changed.

It's a lot, and it's getting worse. But for those of us with the time to work the system, understanding these nuances can still deliver value. Just don't expect it to be simple.

Do you have experience with travel rewards in retirement? Any strategies to share?