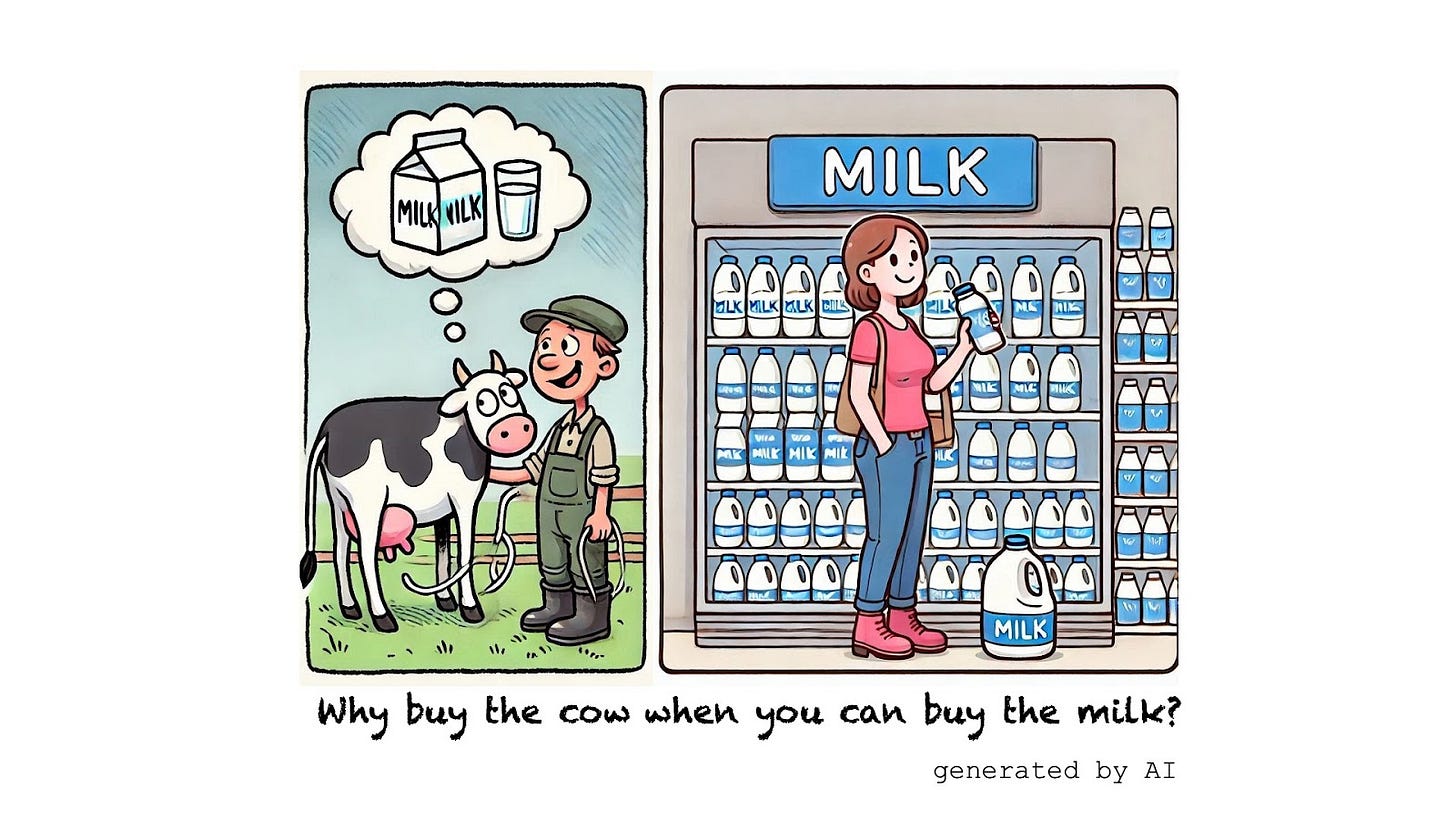

Housing Choices — Cows and Milk

Why buy the cow when you can buy the milk?

OK, this is NOT the expression about cows and milk we’re all familiar with for marriage (if you’re not familiar with the popular expression “Why buy the cow when you can get the milk for free”, John Mulaney explains it well!). But the above variation about “buying the milk” is a relevant one for today’s post about housing choices.

To cut to the chase, this Wednesday post, like others, is from an iMessage thread with friends this past week.

So what do housing choices have to do with cows and milk? Like John Mulaney did with spouses and sex, cows and milk can be used to describe the relationship between single-family homes and living somewhere — (i.e., replace “cow” with “single-family home” and “milk” with “living somewhere”).

If you buy a cow, you get milk for as long as you own the cow. You also have the ability to sell the cow to another farmer, and, if there’s a shortage of cows, the cow’s value could appreciate. Of course, you also have to care for and feed the cow. Feeding the cow may require the need to buy or lease land with a pasture, as well as the potential need to fence off the pasture. There is also the issue of handling the waste, even if there are other uses for the waste.

In the real world, most of us who drink milk just buy the milk and don’t bother owning the cow, the pasture, the fence, and all the goods and services required to care for the cow, feed the cow, manage the cow’s waste, or manage the land for the pasture. Today, farm and ranch families comprise less than 2% of the U.S. population.

However, we live in a world that operates in a different and somewhat odd set of rules.

Imagine this fictitious world.

In this fictitious world, our nation’s dream is to own cows, and there are many tax incentives, government programs, and societal expectations that encourage people to own cows.

People believe that cows are the one of the best places to park wealth. Cows are more lucrative than investing with a local store owner looking to raise capital to share ownership in their venture, investing in fixed income opportunities to help other farmers borrow money to expand their farms, or even investing in other ventures like chickens, crops, or even perhaps toolmaking. This belief that cows are the best place to park wealth creates a virtuous cycle where the price of cows goes up because of the unmet demand of people wanting to buy cows because they believe the price will go up!

We live in this fictitious world for single-family homes. We have many options for how to live somewhere, including buying a single-family home, renting a single-family home, or living in multi-family housing. However, owning a single-family home is a core component of the “American dream.” There are many tax incentives and government programs to help people get into home ownership. And, the societal expectations around home ownership are pretty well ingrained. Moreover, single-family detached homes have been a pretty good investment, largely because of a virtuous cycle where prices go up because people who buy them expect that prices will go up. As such, 54% of housing units in the US are single-family owner-occupied detached homes.

Big difference between buying cows and buying single-family homes, right?

Some real-world comparisons

As my friend mentioned in our iMessage thread, I’ve exercised all of these options for living somewhere or “buying milk” in this analogy.

I rented an apartment

I bought a suburban condo

I owned two different single-family homes

I rented three different single-family homes

I owned two different urban condos

I’ve really appreciated what each of these situations has to offer. Owning a single-family home can be really great. However, each of these situations has its own advantages in the real-world. Let’s explore them!

UPDATE: Paywall removed for Christmas 2024!

The rest of this post is behind a “paywall”. (“Paywall” is in quotation marks because I value engagement more than the subscription fees!) I will “comp” you one month of “paid” subscription if you leave a chat using the link above, if you message me or refer friends to subscribe to this Substack using the links below.

Or, if you don’t want to bother, feel free to try a paid subscription free for 30 days. If you go on to pay, you’ll be treating me to beer or coffee!

Owning a single-family home

We have been lucky to live in places that have grown in popularity while we lived there. With the bulk of our adult lives in Silicon Valley and Seattle, we were living in places that had demands for housing. We owned a single family home in each place.

Leverage

From a financial perspective, a clear benefit of owning in a growth market is the leverage involved in borrowing money. All the appreciation can be realized against a much smaller initial investment.

Consider the following scenarios for the relative appreciation* of both our Silicon Valley and Seattle homes.

* We didn’t actually realize these gains, as we moved and sold our homes before their massive run-ups.

** Source for inflation statistics - 1998, 2001

So, even if purchased in cash upfront, the home investments grew much faster than inflation.

However, the real benefits are the leverage that could be gotten by achieving large absolute gains with relatively little upfront (20% down). This made buying a home and getting into these “investment vehicles” much more accessible to a broader swath of people.

While interest rates sounded scary, there were tax deductions for mortgage interest on the primary home and the value of fixed principal and interest kept adjusting downward with inflation over time.

It’s not hard to see how those living in Silicon Valley and Seattle and who stayed put could realize significant financial gains from their primary homes. This wasn’t us, of course, because we moved around a lot!

Stability

Another clear benefit of owning a home in a growth market is the ability to stay put in a neighborhood and maintain predictable expenses, even when the housing market is hot. We observed price fluctuations in rentals in Silicon Valley, as well as reduced housing availability. We rented the second time we lived in Silicon Valley because of an identity theft issue when I was trying to get a mortgage in 2006, and we ended up renting in 3 different homes to stay in the same neighborhood over a 10 year period. House hunting and moving all the time in a high-demand area is not fun.

Customization

Our first standalone home was a brand new custom home, with great marble countertops, hardwood floor inlays, and nice appliances. We did a lot of things in the backyard. We had the yard tiered where we set up a cool play structure with a club house, a climbing wall, and a slide for our kids. We had a cool deck with a built-in barbecue area with a 5-burner grill, prep sink, and fridge.

In our second standalone home, we were the third owners. Before moving in, we refinished the floors, we put in all new carpets, and repainted. Ultimately, we did other customizations, including putting up a fence, as well as better stairs up to the house. We also benefited from enhancements made by the previous owner, including whole home stereo and built-ins in the home office, in the family room, and in the bonus room.

These types of enhancements aren’t often features set up for rental properties.

Renting a single-family home

We know, in some markets, it is difficult to find nice, single-family homes to rent. We were lucky to have found three different single-family rental homes while living in Silicon Valley that gave us an equivalent amount of space that we had when owning single-family homes.

No worries

Right after moving into our first single-family rental home, there was an earthquake in Silicon Valley. I remember standing in a doorway, facing my wife, with each of us with our arms around one of our daughters. As the whole house shook around us, I could only think “I am so glad I don’t own this home.”

For ten years while renting single family homes, I also appreciated that we didn’t think about moss growing on the roof, the condition of our siding, cleaning gutters, or even window washing. We didn’t worry about leaky faucets, toilet flushing issues, or water heater replacements. We didn’t have to do vendor management of landscapers for either routine “mow and blow” or bigger issues like tree or bush trimming.

New experiences

We also got the benefits while renting single-family homes to live in three really different living situations. We’ve gotten to live on a 1-acre lot with some cool untarnished landscaping, where we had a hawk that would nest in a tree, a buck that would shade himself under that tree, and bunnies that lived on the property. We had another home with a swimming pool. We had a different home within walking distance of two different markets in a more tightly-packed neighborhood with other kids on the street.

One of the things we learned by living in homes of varying price levels is that sometimes nicer things don’t make us happy. Our second rental home was truly a beautiful remodel by a former Google executive who relocated to China. Everything was new and nice, and we got to learn that having nicer stuff than we ever imagined doesn’t actually make us happier. Not only was the rent high, but it was pretty expensive to run the place, with the pool maintenance, high utility bills, and high water bills.

We also learned that living in older places that were perhaps below our original “standards” didn’t make us unhappy. Both the homes we had owned were relatively new with modern amenities, but we realized during our rental experiences that we could make a nice home with our family and enjoy our neighborhoods without a lot of the “luxuries” we had spoiled ourselves with before in newer homes.

Purging

While we never really sacrificed space and still maintained a suburban lifestyle through three different standalone rental homes, the sheer act of moving required some purging of things no longer in use. While our eventual downsizing from suburban to urban life proved challenging, our mindsets were framed well by moving a lot before that. I can genuinely say that there aren’t pieces of furniture or other belongings that we’ve given away that I truly miss. Sure, we’ve had to buy some things (e.g., kitchen stools) over and over again for the needs of new homes, but these expenses are small in the grand scheme of things.

Lower rents than mortgages

While renting, we had the benefit of getting to know three different landlords. Each one had their own different personal and financial objectives with renting their homes to us. There are opportunities to align our desires to save on out-of-pocket costs with landlords who made their investments in their homes a long time ago on a much lower cost basis, with little desire to undergo significant project work, hire property managers, or manage the type of churn that is often involved in trying to solicit top-dollar. To the degree that tenants like us are willing to accommodate the objectives of the landlord, there are opportunities to get good values relative to the market that involve significantly less out-of-pocket expenses than buying a home as a new owner in the same neighborhood. This difference in financial situation between more and less tenured owners in the neighborhood was particularly pronounced in California because of Proposition 13.

Multi-family / Community Living

We’ve lived in community living situations as a renter in an apartment complex, as an owner in a 3-story suburban condo building, and as an owner in two different high-rise urban condo buildings. In this section, I’ll combine renting apartments and owning condos as a single category of community living because so many of the financial benefits of home ownership don’t apply without the appreciation of land, and so many of the freedom benefits of home ownership don’t apply when homeowner’s associations are involved! At the same time, “owning” a condo also doesn’t involve most of the burden of home ownership because the homeowner’s association generally takes care of the building exterior, landscaping, central utility plant, and physical security, all at the expense of monthly dues, which feel more like “rent” than “owning”.

More “Support”

Like with renting a single-family home, apartment living can be truly “no worries” because any problem is just a call to a landlord.

While not quite as “no worries” as apartment living I lump dense, condominium living in this same category. It involves some worry about things inside the unit (Marsha is an expert at a grout and sealant, for example!), but the big issues like the roof, the siding, the windows, the balconies, the landscaping, the sewage, the driveways, and so forth are generally up to a property management company hired by the homeowner’s association.

For example, our property management firm here in Portland has a full-time GM, a full-time engineer, and 9 hourly workers for custodial, porter, and concierge services. There are just so many things that happen on a daily basis that we have no involvement in!

This level of support is in stark contrast to the life of living in a single-family home where we were always personally engaged in some kind of ongoing project.

Convenience

In general, multi-family housing tends to be located in more central areas, and density allows for there to be a lot of conveniences nearby. My first apartment in Menlo Park, CA was right across the street from Safeway (Walk Score 67, “Some errands can be done without a car”). Our first suburban condo in San Mateo was right off El Camino Real, a major street (Walk Score 85 “Most errands can be done on foot”). We were minutes away from grocery stores, restaurants, and just about everything we needed. Our two urban condo units in downtown Seattle and Northwest Portland have had truly excellent walk scores, both scoring 98 (“Daily errands do not require a car.”) We almost never drive.

It’s nice to be able to eat out, go to bars, sing karaoke, visit doctors, and attend sporting events and concerts, all without getting in a car!

Community

The density afforded by not having large homes, garages, and yards which separate people allow neighbors in community living to be very close! We have many friends in our building and in buildings nearby. It’s even nice to be welcomed home by our concierge and building maintenance staff.

Of course, there can be downsides to living in close quarters, as we have had some recent conflict among our owners about how to deal with our defective HVAC system. Still though, I believe our community is getting through these issues.

It’s also important to note that living in a community also means we have to be respectful of our neighbors! One lifestyle change is that we now have to sing karaoke at a local karaoke studio (Voicebox Northwest), and we gave all of our home Karaoke DJ equipment, DVDs, and CD+Gs away to friends!

Conclusion

For me, the biggest reason to own a detached, single-family home is financial. I discussed my alternate investment strategy in a previous Substack post. Personally, I didn’t value the ability to “customize” my home and garden much, and I probably valued the new experiences of living across a variety of homes over the stability that homeownership offered. In my case, the single-family home just felt like a lot of care and feeding (like with cows!) However, I can’t ignore the financial benefits that my friends who stayed in either Silicon Valley or Seattle got from their homes!

From a lifestyle perspective, I have really enjoyed urban living, particularly in Portland. While removing the care and feeding also applies to renting single-family homes, I really enjoy having friends and neighbors really close by and just walking everywhere. After decades of suburban living, I can honestly say we just didn’t socialize with others as often! Of course, the downside is that even though we “own” a condo, high urban property taxes and homeowners association (HOA) dues almost seem like paying rent anyway (or like paying for milk!)

So going back to cows and milk, I choose not to buy the cow (the single-family home). Instead, I like to just buy the milk (paying just to live somewhere, in this case, community living in an urban condo) instead.

One observation I’ve made in my rental community is that it does feel like there is a higher turnover in neighbors to whom you might have formed bonds.

For some, it could be attributed to the american dream of home ownership where renting is often a stepping stone, but there is also simply less friction when moving between rentals…. It is quicker to end a lease and is a far simpler process. You’re also not bound by your ability to sell your house in the proper market conditions.

Some of these relationships are more like situationships where you are more connected by convenience and they will be replaced by others moving in, but this isn’t always the case.

Having been on the other side of the own or rent, I am so glad to have gotten out of being a landlord. Immediately on graduating from the UW and landing a real job, my Dad insisted I buy a house. A 3 bed, one bath 1960’s crackerjack box (950 sq ft) for $49,950. My mortgage was $350 a month (interest rates were 7.5% and climbing). Had I kept it, would’ve long been paid off. I lived in it for about a year, got married and rented a duplex in Auburn, closer to work for both of us. Got a deal to buy a family friend’s house with lifetime occupancy (she had terminal cancer). We’d start payments after she passed, owner financed into a joint account with her niece (only living family member) who was a TV News anchor in Japan. She traveled a lot and stopped by every so often to clear out the account. And so 3 weeks before 1st son was born we owned 2 houses and 2 mortgages. Moved to the bigger house and 1st order of business was set up the nursery, paint, furniture, crib, etc. And rent out my original house. Painful as you mention all the things renters don’t care about, the landlord has to take care. Even with my travel for the job; broken front window (kid threw a basketball in the winter), flooded kitchen (lost a knife down the drain which eventually wore a hole in the bottom of the trap), unauthorized cats peeing on carpet (destroyed) and burned the hard wood floors. Replacing the hot water heater, stove, removing unauthorized hideous wall paper in the bathroom, removing unauthorized carport enclosure that now sort of looked like a garage. Having a nice family fully vetted to rent, turn into the father being kicked out by the unemployed with 3 kids ex-wife who couldn’t pay the modest rent by todays standards yet I still had a monthly mortgage. And months before I could get them out. This happened twice and I gave the demon house to my Dad who loved doing rentals since he was retired and had the time. Moved twice more and finally built the house we’re still in. Another story in itself. They say the hardest thing in a marriage is to build a house. I modeled the plans in 3D in “Walkthrough” by Virtus. I was doing a beta test for the Windows version of the original Mac program that was being used in the film industry to set up shots. We adjusted the bedrooms to have exactly the same square footage for the kids. The doors were enlarged to be able to handle a wheelchair if my wife needed one (chronic pain syndrome in leg). And zero stairs., not even the step usually into the garage. Just a slight ramp. We went over budget but I found a way to make it happen. It’s my cow.