After a few weeks straight of posts about politics, I’ve decided to revisit another aspect of this Substack, this time focusing back on the financial side of retirement. Today is November 10, and this is episode 11.

While much of the news about the One Big Beautiful Bill Act has been about what the government isn’t doing, I thought this week it would make sense to talk about what we can do as citizens. As 2025 draws to a close, there’s something those of us in the GenX and Boomer generations should be looking at to direct our long-held stocks with unrealized gains more strategically to charities. I’ll be talking about the Donor Advised Fund or DAF.

The 0.5% Floor

One of the things that the OBBBA did is change the rules around charitable giving to disadvantage those who itemize deductions, which is many of us who live in places like Portland, with high income taxes and high property taxes.

Starting next year in 2026, those who itemize deductions can only deduct charitable contributions that exceed 0.5% of adjusted gross income (or AGI). For example, with a $200,000 AGI, the first $1,000 of donation is no longer tax deductible.

Of course, there are other changes, which enable those with the standard deduction to now deduct up to $1,000 (or $2,000 for couples). And, there is a 35% top deduction rate for charitable contributions, which will impact those at the 37% federal tax bracket.

However, the one that affects me and Marsha is the 0.5% floor. While we don’t give to charity to avoid taxes, the current spending by the Federal Government on things we don’t support like an increase of $75 BILLION for funding for ICE makes me want to ensure our dollars to local charities goes further. The recent $200M spend on luxury Gulfstream jets by Kristi Noem simply amplifies this desire.

The change for 2026 means that those of us who itemize will lose the ability to deduct smaller annual gifts unless they exceed the new threshold. It also makes 2025 the last year to take full advantage of current deduction rules.

Donor-Advised Funds

A donor-advised fund or “DAF” allows us to make a one-time charitable contribution, receive an immediate tax deduction, and then distribute grants to charities over time.

By contributing a larger amount in 2025, we can “bunch” multiple years of donations into one tax year, maximizing our deduction before the OBBBA changes take effect.

Moreover, much like an IRA, 401(k), or HSA fund, assets in a DAF grow tax-free, making more funds available to charity.

Most significantly, we can contribute stocks that have a lot of unrealized gains and avoid a capital gains tax, allowing the money to work for the charity and not the Federal Government.

The concept is that our investment advisors can simply set up the fund, invest the assets, and direct the money to the charities of our choice.

Real-world example

We’re planning to use our relationship with Northern Trust to implement a DAF.

In our case, we are holding a number of stocks we’ve had for a long time like Apple, Visa, and Alphabet with unrealized gains. Without realizing a capital gain, we can donate the shares to a DAF, have the DAF reinvest the shares to grow tax free, and use the funds to support the charities we choose over time. For us, this has an even larger impact because Oregon taxes capital gains as ordinary income. With no realization of capital gains, the money avoids taxation in Oregon, too, providing maximum impact to the charity.

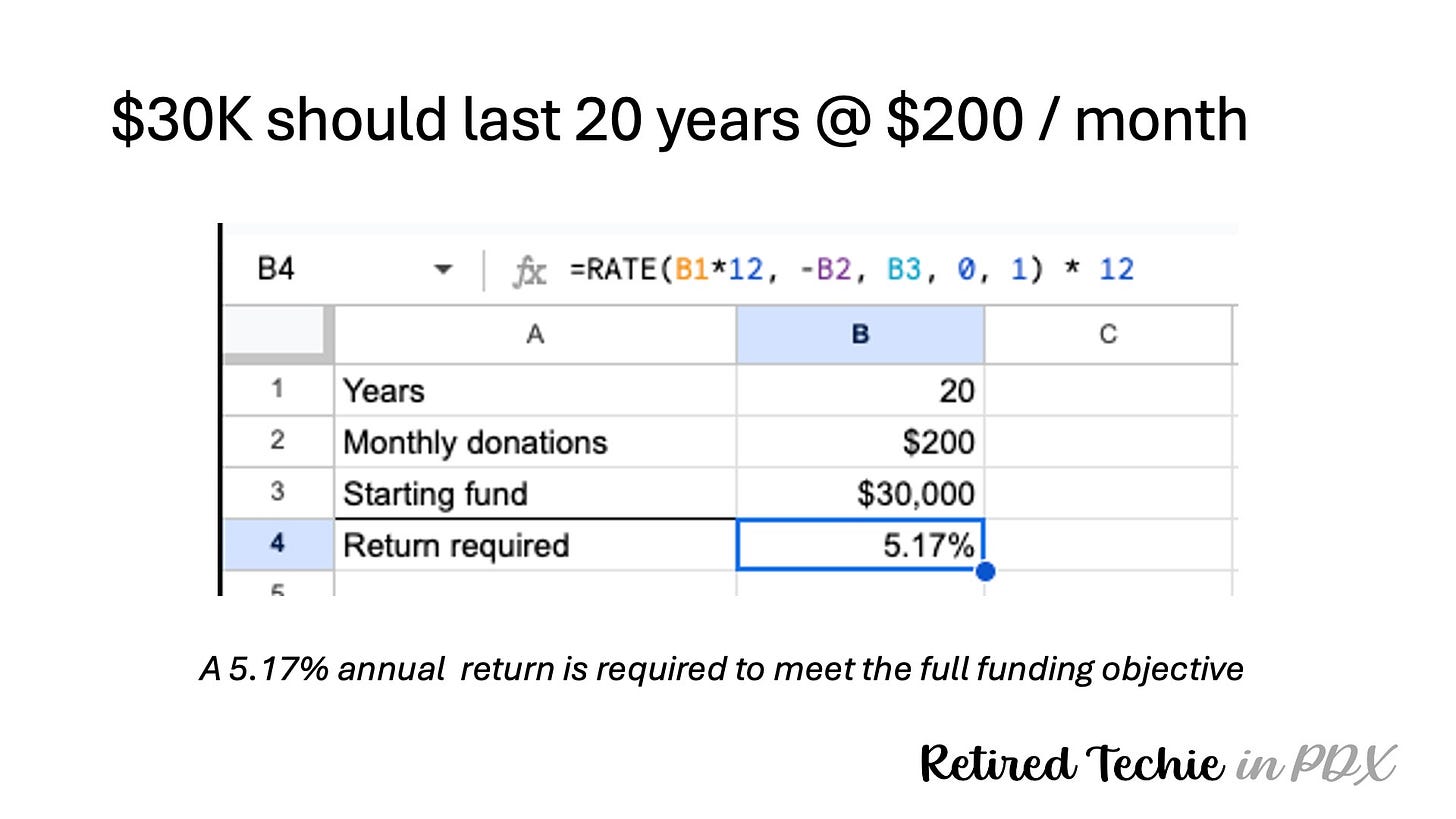

For now, we’re not planning any significant giving beyond what we give to charities anyway. Instead, we are just planning out the giving for the next 20 years to maximize its impact. We decided to model giving away about $200 per month for the next 20 years. This would be about $30K now, assuming a modest tax-free appreciation in the fund. For us, this amount falls within the deduction limit of DAF contributions of appreciated assets to 30% of AGI.

Setting up the fund now will allow us to take a $30K tax deduction now, avoid tax on any unrealized long-term capital gains, avoid future 0.5% floors for charitable donations, and allow the fund to grow tax-free to maximize future donations. Tactically, we also won’t need to track receipts or manage the transactions ourselves anymore!

Community impact

My intention in the past has normally not been to avoid federal income taxes. However, watching the current cruelty by the federal government in its withholding of SNAP payments to 42 million Americans has emphasized an ongoing need to support local charities that are filling in the gaps left by the government.

In my case here in Portland, causes we have donated to include:

Portland Rescue Mission (CharityNavigator submission out-of-date) and Blanchet House– Serving people experiencing homelessness with meals, shelter, and recovery programs.

Rose Haven – A day shelter and community center for women, children, and marginalized genders.

Raphael House – Supporting survivors of domestic violence with shelter and advocacy.

In addition, there are some other associations we plan to give to. One in particular is The Peer Company (formerly Mental Health and Addiction Association of Oregon). True to its name, it empowers people with lived experience with mental health and addiction issues to lead recovery and support services.

These services fill gaps left by government services. Marsha and I will continue to be intentional about how we want to direct funds.

Why 2025 was our year to act

While the DAF is not a new structure, the OBBBA changes to charitable giving put more of our background attention on this vehicle earlier in the year. The government shutdown and its impact on members of our community was the straw that broke the camel’s back.

For us, 2025 offered the right opportunity to:

Maximize a tax deduction

Avoid capital gains tax

Lock in years of future giving

Support local nonprofits with lasting impact

To us, this was both a strategic and meaningful move to shift dollars from the federal government to local charities.